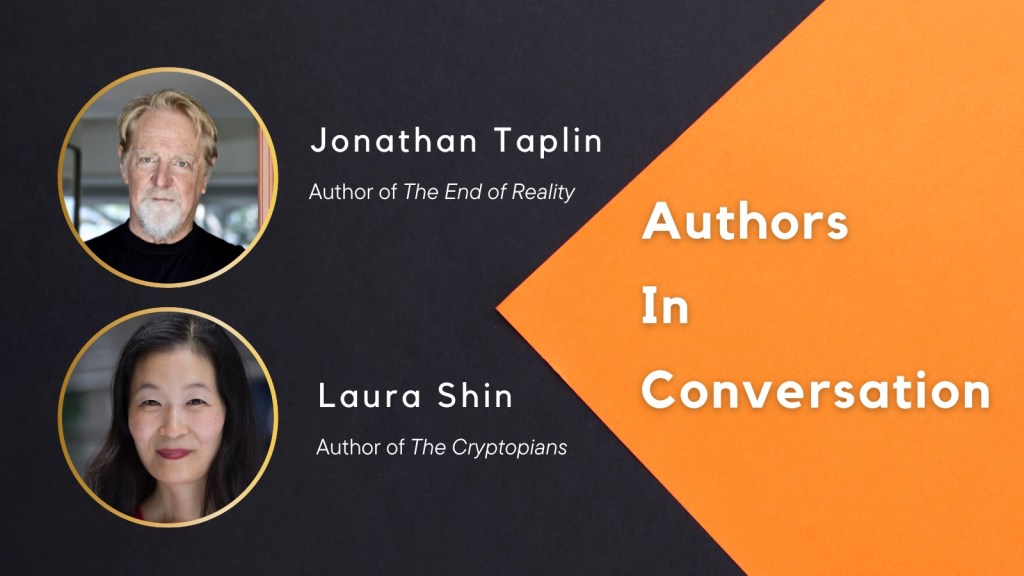

Is crypto a pump-and-dump scheme? A conversation with Jonathan Taplin and Laura Shin

It’s been roughly two years since the cryptocurrency market peaked, and though assets like Bitcoin have recovered to a certain extent, many investors are still reeling from the more than $2 trillion that were lost.

For some, the so-called “crypto winter” was inevitable — the natural endpoint for what essentially amounted to a vast Ponzi scheme. In that camp is Jonathan Taplin, who’s seen the crest of nearly every cultural wave of the past 50 years. He was tour manager for Bob Dylan and the Band, producer of major films such as Martin Scorsese’s Mean Streets, an executive at Merrill Lynch, creator of the Internet’s first video-on-demand service, and now the author of a new book The End of Reality: How Four Billionaires are Selling a Fantasy Future of the Metaverse, Mars, and Crypto.

However, other experts have a different take on what’s been happening. While some in the space may be looking to get rich quick, crypto also offers the opportunity to create decentralized, user-owned networks that could help redistribute wealth away from billionaires. That’s the argument made by Laura Shin, a former senior editor at Forbes, a crypto journalist, and the founder and CEO of crypto news outlet Unchained. Shin recently published The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze.

In our conversation, which has been edited for length and clarity, Taplin and Shin discuss the promise — real or imagined — of the crypto industry.

PublicAffairs: Jonathan, you’re pretty hard on the crypto industry in your book. Have your feelings changed at all since you finished writing?

Jonathan Taplin: No. I think Bitcoin may have some uses, but in general, I think there’s been more fraud in crypto than almost any place I can imagine, and I don’t think it has a real purpose.

The United States currency is backed by the full faith of the US government. Crypto is backed by our faith in scammers like Sam Bankman-Fried. In the fall of 2021, I saw a chart where about 91% of all Bitcoin was held by 2% of the holders.

And then in the winter of 2021, starting around the end of the football season, there was maybe $250 million worth of ads for FTX and other crypto exchanges, with celebrities telling you that crypto is the way to make great wealth. The evidence shows that a huge number of the whales started selling Bitcoins at $60,000, and by the late spring, Bitcoin was down to $19,000. So the suckers went in with all the advertising, while the big boys got out.

PA: Laura, I imagine you have a different take on the situation.

Laura Shin: Yes. What’s been so interesting to chronicle with the rise of crypto has been that, especially earlier on, a lot of this was led by the people. Bitcoin is the obvious example here. The creator, Satoshi Nakamoto, is an anonymous person or group, and they don’t appear to have taken any value out of the system. When you look at the ledger of all the blockchain transactions, you don’t see that they’re cashing out in any way, right? So this person or group, seemed to just want to create some form of money that wasn’t in the control of really anybody.

It’s not in the control of the government or a company, and there’s no board members or C-suite. And what’s so remarkable is that Bitcoin still has so many thousands and thousands of people around the world working on it, and it didn’t have to hire anybody. There were no stock options, there was no health insurance. It just created the system and then the incentives were there and people started to want to work on it.

As for the fact that the US dollar is backed by the US government, many currencies before the dollar were dominant and no longer are today. Look at British pound sterling, which a hundred years ago was the global currency. By mid-20th century, that had changed. Ages ago, people used cowrie shells as money. There’s nothing so magical or different about the US dollar that makes it infallible.

PA: Jonathan, you see crypto as part of a larger trend — a fundamental difference that’s at the heart of your book, really. Can you explain that idea?

JT: There really are two views of America’s future on offer right now. One argues that the collective investment priorities of our society should go towards solving the issues like climate change, mental health crisis, and housing. But the other view, held by the four billionaires I focus on in the book — Elon Musk, Mark Zuckerberg, Peter Thiel, and Marc Andreessen — is much darker. It’s a vision of the future where artificial intelligence and robots ruled by Musk and Andreessen and Teal and Zuckerberg do most of the work, and a large portion of the population sits at home on the metaverse.

In this world, the average person will be subsisting on government-paid crypto universal basic income because there won’t be enough work. Plus, Musk believes that our planet is doomed anyway, so we have to go start over again on Mars and bring our own oxygen. To me, it is just a vision of the world that’s insane, and that’s why the book is called The End of Reality. Fundamentally, we’re in a place where we have to decide what kind of society we want: one that’s built for machines, or is it built for people?

LS: I see crypto as a potential — and I stress the word “potential” — antidote to what Jonathan’s describing. We’ve seen an unprecedented transfer of wealth to everyday people through crypto. At some point in the last several years, young grads out of college started wanting to work not on Wall Street, but in Silicon Valley. And what’s so incredible to see now is that even in the crypto space, Silicon Valley isn’t the center of the world.

I know people who have created things, who have backgrounds in the Philippines, in India, they really come from places that have not seen much opportunity in the world. I don’t know if any of them fall into the rank of a billionaire yet, but I mean, it’s kind of incredible what I’ve seen.

JT: I think decentralization is a lie. I mean, I’ve seen data suggesting that the top 2% of accounts still own 95% of the $800 billion supply of Bitcoin. So I have a hard time believing that decentralization is true. I’ll also point out that many of the things I said in my book have come true. For example, nobody is going to the metaverse. The whole project is even being abandoned by people at Meta.

LS: I’m a bit more optimistic, and I’ll admit that I totally agree with you about the pump and dumps. Whenever there’s a bull market, you’ll see a lot of press about that because it’s definitely a huge part of what’s going on. But the decentralization movement that’s coming out of this is real, in my opinion. Like, I really have seen that it’s taking away from the typical centers of power, and I frankly feel that that kind of change is probably good for the world.

The story of the idealists, technologists, and opportunists fighting to bring cryptocurrency to the masses.